Apartment Management Magazine Buying Real Estate: Measuring the Risks vs. the Rewards

By Christopher Miller, MBA

Specialized wealth management

Which investment is more desirable: one with moderate projected return and moderate risk, or one with slightly higher income and slightly higher risk? The answer to this question depends on the investor asking the question and their individual financial situation.

As a real estate investment advisor, I always work with my clients to find the properties that are right for them; investments that best match their personal risk / return goals.

The objective of investing

As investors, we look for companies that match our goals and our tolerance for risk. Real estate is my preferred investment vehicle because it offers income potential – with tax advantages – during the holding period and the possibility of great appreciation; especially when leverage is used.

If I had a million dollars of money to invest today and invested it in stocks, would I be surprised if they are worth $ 600,000 next year? I shouldn’t be. This is what actions do; their values are volatile and can fluctuate enormously. What will these actions be worth in 10 years? After, I hope. Hope is the key word in this phrase because it is virtually impossible to build a financial model to predict stock returns.

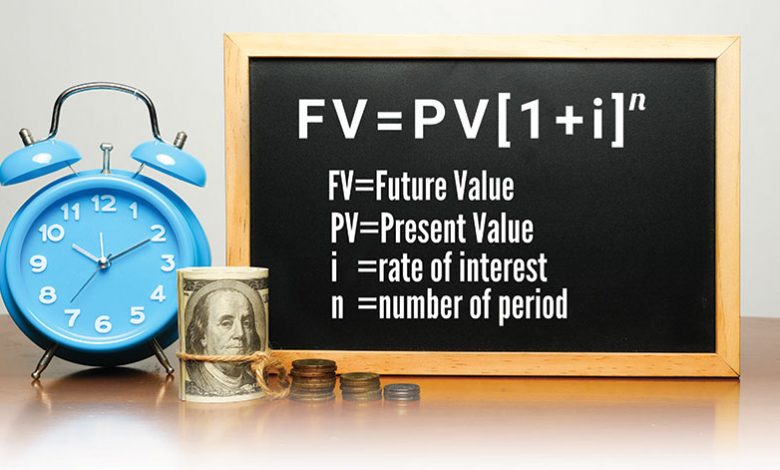

Let’s say, on the other hand, that I invested that $ 1 million in real estate. While I certainly couldn’t be sure the property would still be worth what I paid for next year, I would be confident that the property’s value would increase over the next decade. Prior to the purchase, I would create a financial model using reasonable projections to help me predict this. For example: I can put $ 1 million on a $ 2,000,000 property and borrow the rest for 30 years at 4%. For our 10-year resale projection, we estimate rents and expenses to increase by 4% per year. If I bought at 5% CAP rate and sold at 6% CAP, that would give me a potential selling price of $ 2,900,000. Since the loan balance will have decreased to $ 760,000 by then, I have $ 2,151,000 in proceeds left – doubling my money over 10 years.

This is why I love investing in real estate so much. If I create a model and use reasonable assumptions, I can make projections that help me feel comfortable with investing. I realize that there is always a risk – but the potential reward makes that risk worth it. I didn’t start my article this way to give stockbrokers a hard time or to convince you to buy real estate investments. As you read a post aimed at homeowners, I know I preach to the choir. While there are many risks involved in buying real estate, I wanted to focus on a few in particular this month:

Income risk

Income risk refers to the risk we take that our income will continue. For net leased properties, will the tenant continue to pay the rent? If the tenant’s lease expires, will he renew it? If not, what are our prospects for finding another tenant to move in and keep the income? We can address these risks by sticking to tenants with strong credit and long-term leases. Additionally, we’ll want to buy in robust metropolitan areas to make reletting the property as easy as possible – if we ever had to.

In apartments, will we be able to maintain occupancy and rent levels high enough to generate a profit every month after the bills are paid? Will unforeseen expenses have an impact on our future income? Careful analysis of the property and its surrounding market is required here. After a thorough inspection of the improvements, the future costs of all capital expenditures (major maintenance work) should be estimated. My managers will usually create a reserve fund to pay for these costs over the period of ownership.

Inflation / appreciation risk

If your money doesn’t go up, it goes down – thanks to the power of inflation. I’ve never been a big fan of bonds because when I buy a 10 year bond I pay $ 1,000 (if I buy at par.) When the bond matures I get my 1 back. $ 000 – but it’s not worth as much as it was when I paid it 10 years ago. The income I receive from the bond must make up for this difference. If a 10-year California municipal bond has a yield to maturity of 3%, will that be enough to cover inflation and give us a profit? I do not think so.

While we want to be sure that our property income will rise to beat inflation, we want the same for the value of our properties. I buy real estate for income and growth – and expect to see both of my properties. How can we give ourselves the best chance of achieving both? For net leased properties, we need to look at the rent increases contained in the lease. If there is no rent increase, we probably don’t have much appreciation potential. In apartments, you can stay one step ahead of inflation by buying in growing metropolises. A growing demand for housing, a growing population and growth employment could continue to create growth rents and growth value to us.

Leverage risk – To borrow or not to borrow?

When I borrow money to buy a property, my # 1 risk is that the property income goes down, I can’t pay the mortgage, and the bank takes my property away. Thus, any property purchased with a loan certainly carries more risk than a property without leverage. However, there are some important advantages to using leverage that many of my investors believe justify this risk.

The main benefit is depreciation: when I sell a property that has been fully paid off, I have probably used all of my depreciation, so I don’t get any tax benefits every year. Buying a leveraged property, via a 1031 exchange, will allow me to do what the IRS calls buy a new base: the amount of the good bought by the loan can then begin to be amortized immediately. If I sell a property for $ 1 million and use it at a moderate 50% rate to buy a $ 2 million property, I just bought $ 1,000,000 of that “new base”, this which gives me $ 29,090 in annual tax deferral for my income.

Leverage properties can also give us the opportunity to see greater appreciation. If I buy a property for $ 1,000,000 for cash and sell it for $ 2,000,000, I have doubled my money. If, on the other hand, I buy this property with a $ 500,000 down payment and a $ 500,000 loan, I just turned $ 500,000 into $ 2 million – that’s four times my money. And what could my investment with the remaining $ 500,000 of equity be done as well? Using leverage to increase our appreciation potential is what has made our success in real estate over the years.

All investments involve a balance of risks. What return do you want and what risk do you want to take to get it? These issues should be carefully considered before making any investment. If you have any questions, my office phone number is (877) 313-1868.

Christopher Miller is Managing Director at Specialized Wealth Management and specializes in tax-advantaged investments, including 1,031 replacement properties. Chris’ real estate experience includes working in business valuation, institutional acquisitions for a national real estate syndicate and as an advisor helping clients through more than four hundred 1031 exchanges. Chris has been featured as an expert in several industry and television publications and earned an undergraduate degree in commerce and an MBA focusing on real estate finance from the University of Southern California. Chris started his career in real estate in 1998. Call him toll free at (877) 313 – 1868.

Securities Offered By Emerson Equity LLC, Member FINRA/SIPC. Emerson Equity LLC and Specialized Wealth Management are not affiliated. Any investment involves risks. Always discuss potential investments with your tax advisor and / or investment professional before investing.