What We Know about Adam Neumann’s Flow

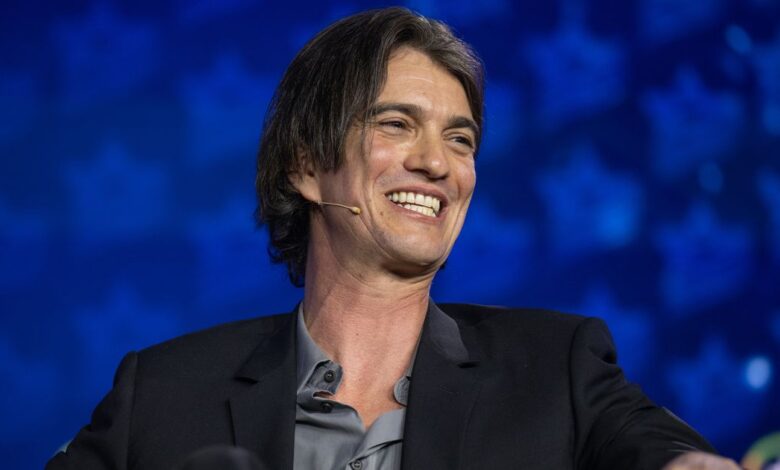

Photo: Shahar Azran / Getty Images

When Adam Neumann launched Flow, his residential real estate company, just over three years ago, many people were skeptical. The man who had managed WeWork in the ground spectacular fashion was launched another Way, ambient-y-immobilier? And people threw money again to do it? Like WeWork, the flow seemed overvalued-it had an evaluation of $ 1 billion from the start, thanks in part to $ 350 million from the A16Z venture capital company in Andreessen Horowitz, the largest unique investment that the company had made at that time. “If a start-up is worth $ 1 billion before launching a product, it’s probably a scam,” said Jason Calacanis, a podcaster and a providential investor, tweeted at the time.

Since then, the details surrounding the flow have remained mysterious. But money continues to come. Bloomberg recently reported That Neumann has raised an additional $ 100 million, including more A16Z money, which has more than doubled its evaluation at 2.5 billion dollars, and provides for an IPO. For anyone in multifamilial activities, it is more than a little confusing: the flow has a portfolio of around 4,000 luxury rentals in several cities in the southeast – considerable for a regional but barely enormous company. (Favorite apartments communities, which was acquired by Blackstone In 2022, a 12,000 in the region.) And in terms of new developments, it only has one currently under construction: a rental tower / condo of 466 units in Miami. He too just sold Its financially disturbed development in Nashville at a loss. In addition to fashionable interiors, intangible tag words like community And GOOD–beAnd a tote bag This indicates “Holy Shit I’m Live”, we do not know what flow offers that other luxury owners are not. So why do people continue to throw money there?

After the disgraced but lucrative pandemic from WeWork, Neumann bought Majority participations in a portfolio of 4,000 rental units in Atlanta, Fort Lauderdale, Miami and Nashville to be owned and operated by Flow. THE Wall Street Journal reported that Neumann, who left WeWork a multi -loving after being forced to go out As CEO, his own money was investing this time. It seemed that Neumann had learned something from his previous race: unlike WeWork, which was built around the sublet and management of the office space he did not have, Flow would have the properties it managed, a more stable commercial model. Otherwise, he shared many similarities. The flow properties, like WeWork, would also have many advantages, services and integrated brand, things that theoretically helps it stand out and seem innovative in a crowded industry.

Neumann has happened in partnership with other developers to create projects that are at various completion stages: Flow-houseA condo / rental development of 466 units in Miami WorldCenter which should open its doors later this year, and a three -point Mixed and residential complex office in Aventura with the Israeli company Canada Global. In addition, Flow joins forces with Canada Global to redevelop a 16 -acre trailer park in El Portal in a mixed use project with 2,380 apartments. The company also has properties in Saudi Arabia, according to its website.

When Neumann launched a flow in the summer of 2022, he said that society would revolutionize the housing industry by creating a community, promoting well-being and, and, and, and, and, and, and, and, and, and, and, and, and, in words De Horowitz, transforming the rental of an apartment from a “soulless experience” into, well, something less soulless.

According to its website, Flow creates “communities designed to connect with your neighbors, yourself and the natural world”. By offering a “high experience” and a “community” to the tenants, Neumann explained During a conference, they would have the impression of “being part of something”.

In reality, this seems to shake something in the direction of WeWork but for housing: apartments with more flexible rental terms (short and long -term rentals), an option to rent a furnished unit, a attractive brand and a more robust slate of community events and programming. Although there have been early suggestions to use cryptographic portfolios for payments, the models of based rent and technological improvements (for example, there is a FLOW application that an “lubricant” of its Las Olas building in Fort Lauderdale, although online systems are fairly standard in luxury rentals), so far, innovation has been limited. It seems essentially focused on improving the management and experience of tenants. When Business insider visited Society Las Olas, the residents indicated that the building was cleaner than it had been under the previous direction, with five staff members in the hall (or “lounge residents” as renowned flow) compared to a single concierge, new gymnasium equipment and a less clumsy construction application. There is also a new restaurant by the pool.

From the point of view of companies, all of this seems to be at the service of reducing turnover – dear for owners and tenants. Do residents feel a greater feeling of connection in a well-managed building? Probably, at least in the sense of not counting the days until their lease is increasing. But Neumann suggested that he promotes a more fundamental feeling of belonging. As he said to A conference in 2023: “If you are in a building and you are a tenant and your toilets are obstructed, you call the Super. If you are in your own apartment and you have bought it and you have it and your toilet clogs, you take the piston.” (Presumably, the lines are blurring in a flow building; a tenant of flow would take his own piston, and an owner of flow would call the Super because they would not feel alone in the process.)

Despite what happened in WeWork, a number of people I spoke with pointed out that Neumann was really good to convince people to buy his vision And give him money. “He knows how to create a fun atmosphere and understands the atmosphere between art and real estate,” explains a multifamilial developer. In other words, it is really good for the brand. And maybe the stable image of a luxury owner could use a brand change?

A company based on multifamilial housing is also much less volatile than that built on the desk space sublet to the WeWork, as illustrated by the Krach of the offices and the subsequent bankruptcy of WeWork. When the value of the office space has dropped, WeWork was locked in expensive leases, it had to be renegocative or lose money. Multifamily accommodation, on the other hand, is much more stable. Even if rents stagnate, the country has a major housing shortage and demand will remain high.

While nobody with whom I spoke to Flow expected to do anything revolutionary, the developer stressed that Neumann could very well draw a compass – raising tons of capital by promising a advanced revolution and technology. And when it is clear that revolutionary things are not going to take place, it has become a huge actor, although largely traditional of industry.

“If you are an investment company, part of what makes you succeed is the capacity to collect funds,” explains the developer. “I think it has a decent chance of succeeding. I think it also has a decent chance of believing its media threshing and chasing windmills. ”

Neumann continues to conclude agreements with new partners and investors, more recently the Aventura and El Portal agreements with Canada Global. But he also lost a property and majority participation in another: Flow has just sells his in financially difficulty Property of 358 nashville units in Tishman Speyer for less he paid. (Ownership lost $ 3.7 million in 2022 and $ 3.6 million in 2023 due to rental concessions and investment costs; Flow told Business Insider He had never managed the property and was a minority owner.) The flow would also be Sell a stake In the property of Buckhead, of Atlanta of the company, would have been in distress, to another multifamilial owner. To be fair, many rental properties in the Southeast have experienced similar problems. A researcher in finance with whom I spoke explained that the belt rental markets saw enormous rent increases after COVVID, were then flooded too many new units online and now see the rents fall.

As for a near future, Bloomberg said that, according to its leaders, the flow would be positive in cash this year. In other words, he always loses money.