What Can Disqualify You from Renting an Apartment?

Renting an apartment can be a challenging and stressful process. That is especially true when you’re not sure what qualifications landlords and property managers are looking for while doing background checks. The last thing anyone wants is to be disqualified from apartments for rent due to a mistake or lack of understanding during the application process.

By understanding what can disqualify you from renting an apartment, you will be better equipped to improve your chances of being approved for a rental. Whether you’re a first-time renter or an experienced tenant, being aware of valuable information can help you navigate the rental process with confidence.

What Can Disqualify You From Renting an Apartment?

To help you avoid any surprises or disappointment, we will help you explore what can disqualify you from renting an apartment. That way, there will be a higher chance that your potential landlord will approve your rental application. Let’s have a look at each of the factors.

Criminal Record

A criminal record can significantly affect a person’s ability to rent an apartment. Landlords and property managers may conduct a criminal background check on prospective tenants to determine if they have a criminal record. If a prospective tenant has a criminal history, it may disqualify them from renting an apartment.

Types of Crimes

Some types of crimes (such as violent offenses or drug-related crimes) are considered more severe and might result in automatic disqualification from renting an apartment.

Other types of crimes, such as minor misdemeanors or non-violent offenses can be considered less severe. These might not automatically disqualify a person from renting an apartment. However, landlords and property managers might still take any criminal record into consideration when evaluating a prospective tenant’s rental application.

The Criteria of a Property Manager or Landlord

Some landlords and property managers have their own policies and criteria for accepting tenants with criminal records. For example, some landlords have a “one-strike” policy where one criminal conviction is enough to disqualify a person from renting an apartment. Others might have a more lenient policy that takes into account the type of crime, how long ago it occurred, and whether the person has demonstrated rehabilitation.

Policies Do differ in Some Countries

In some countries, landlords and property managers are prohibited by law from discriminating against prospective renters based on their criminal records unless there is a direct correlation between the tenant’s past criminal behavior and the potential for harm or damage to the landlord’s property or other tenants.

Income and Employment History

Landlords and property managers can be hesitant to rent to someone who has recently lost their job or has a history of frequently changing jobs. That is why they prefer taking a security deposit from their potential tenants.

Several types of income and employment issues disqualify a person from renting an apartment after the background check:

Insufficient Income

If a prospective tenant’s income isn’t high enough to meet the landlord or property manager’s income requirements, they may be disqualified from renting. This is typically determined by comparing the tenant’s income to the rent. Most landlords require the tenant’s income to be at least three times the amount of the rent.

The best bet is to play safe. Therefore, it is wise to know if selling your house and renting an apartment is a worthwhile decision.

Job Instability

Landlords and property managers may be hesitant to rent to someone who has recently lost their job or has a history of frequently changing jobs. They might consider a tenant who has been at their current job for a significant amount of time as more financially stable and reliable.

Self-Employment

Some landlords and property managers prefer tenants who have a stable, traditional job over those who are self-employed. That is because they would have difficulty verifying self-employed income and may consider it riskier.

Same goes for unverifiable income. Some landlords require documentation, such as pay stubs, tax returns, or bank statements, to verify a prospective tenant’s income. If the tenant is unable to provide this documentation, the landlord might disqualify them from renting.

However, these issues can vary depending on the landlord or property manager’s policies and criteria. It also depends on the local laws and regulations of the area you are in. Therefore, it is always a good idea to check with the local authorities to know more about these requirements.

Rental History

A rental history of evictions or violations of lease agreements can be seen as red flags and might disqualify a person from renting an apartment. Some of the types of rental history issues that disqualify a person from renting include:

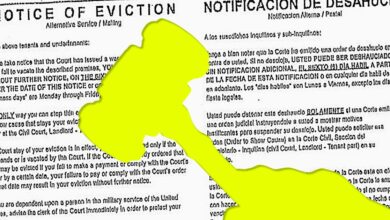

Evictions

An eviction can significantly affect a person’s ability to rent an apartment. Evictions occur when the previous landlord takes legal action to remove a tenant from a rental property for non-payment of rent or for violating the terms of the lease agreement.

If a prospective tenant has a history of evictions, the former landlords might view it as a sign that they have difficulty following lease agreements. A potential landlord would be hesitant to rent to someone with a history of evictions.

Unpaid Rent

A history of unpaid rent or bounced checks may indicate that a prospective tenant does not have enough money to be able to pay rent on time, which may disqualify them from renting an apartment.

Unpaid rent also indicates that the landlord has had to take legal action to collect the rent. So, this is a sign that the tenant is unreliable or irresponsible when it comes to paying their bills.

Lease Violations

A history of violating lease agreements, such as having unauthorized roommates, pets, or subletting the apartment without permission, may indicate that a prospective tenant is not respectful of the terms of the lease agreement. That is when knowing about the apartment pet policy can help you.

Causing damage to previous rentals (either intentional or unintentional) may indicate that a prospective tenant isn’t responsible enough and might not take good care of the apartment.

Short Tenancy

If a prospective tenant has a history of moving frequently or having short tenancies, landlords and property managers view them as high-risk tenants who may move out quickly, leaving them with an empty unit.

However, it depends on the landlord or property manager’s policies and criteria. Therefore, it is always a good idea to check with the local authorities to know more about these requirements. Besides, you can learn more about renting an apartment with no rental history so you can get your rental application approved.

Credit History

There are several types of credit issues that disqualify a person from renting an apartment:

- Low credit score: A poor credit score or a bad credit score is an indicator of poor creditworthiness and may indicate that a prospective tenant has a history of late payments or high levels of debt. Landlords and property managers may view a low credit score as a red flag.

- High levels of debt: High levels of debt, such as credit card debt, auto loans, or student loans indicate that a prospective tenant isn’t financially stable and might struggle to pay rent on time. Landlords and property managers might analyze that the debt to income ratio of the potential tenant does not fit their requirements

Some Other Credit Issues

- Late payments: A history of late payments, such as missed or late credit card or utility payments, indicate that a prospective tenant is not financially responsible

- Bankruptcy: A recent bankruptcy indicates that a prospective tenant has experienced severe financial difficulties and might struggle in terms of paying rent on time

- Foreclosure: The credit check of a recent foreclosure indicates that a prospective tenant has struggled with significant debt in the past and might have difficulty paying rent on time

The Takeaway

It is always a good idea for prospective tenants with a criminal history or low income to be transparent with the landlord or property manager. You need to assure them that you can pay monthly rent on time. You can also bring any relevant documentation, such as your credit report, proof of rehabilitation, or a recommendation letter from your past landlord. This can help increase your chances of being approved for a rental.

In some cases, landlords and property managers may ask for a guarantor or co-signer if you don’t have a good credit score.

Now that you are aware of the factors that might disqualify you from renting an apartment, it is time to keep this information in mind and act accordingly. The next step is to know about the different ways to find apartments for rent!