Are Y Combinator Demo Day Valuations Too High? Or is the Market Efficient?

In 2015, Sam Altman released his famous evaluation challenge, asking opponents of the startup and callers of bubbles to place a friendly six-figure bet. Sam chose three baskets – late stage, middle stage and the whole YC graduation bundle from winter 2015. The bet was that by 2020 each basket would meet certain valuation targets, providing investors with an excellent return on risk.

Mid-stage results – Easy victory for YC

For the intermediate bucket, he wins easily. It’s not even close. The official bet was that a basket of 9 “mid-range” YC companies, most of the early unicorns or close to them, would eventually triple in overall value. Of the 9 companies, at least three alone meet the valuation requirement for the entire group. At every step of the 5-year bet, this handful of companies have consistently looked solidly ahead of their 2015 valuations, and solidly ahead of the already very strong S&P and Nasdaq returns over the period.

Not all businesses had completely smooth navigation. The most volatile was Zenefits, which soon after reaching $ 4 billion in mid-2015 has seen management change and has faced allegations of securities fraud from some venture capitalists (the got a better rating). Others have not had any particular incidents; maybe they just slowed down their growth. However, when one company stumbled, the others more than made up for the difference.

Pull the bet another year, and things are even better for YC alumni. Stripe, Coinbase, and Instacart have private valuations totaling over $ 200 billion, giving the whole basket a 10x-20x return (some dilution along the way).

Late results – A year late?

The late stage bucket initially underperformed, but in 2021 it got ahead. Technically, Sam loses the bet. On January 1, 2020, Uber and Lyft went public with mixed results. Several other companies had poor IPOs compared to their last private valuations, or were delaying their IPOs. Airbnb was still growing rapidly before Covid, but they weren’t big enough to carry the 5. The initial bet was that the 6 companies, worth $ 100 billion in 2015, would double by 2020.

Of course, by 2021 the tides have completely turned. Uber, Airbnb, Pinterest, DropBox, and Palantir all have public ratings. Their total market capitalization exceeds the target. You don’t even need SpaceX, which holds more than 1/6 of the $ 200 billion load. Was Sam’s time horizon too short by a year? Or have we caught a new bubble? Reasonable people can disagree.

Are the YC Demo Days ratings too high?

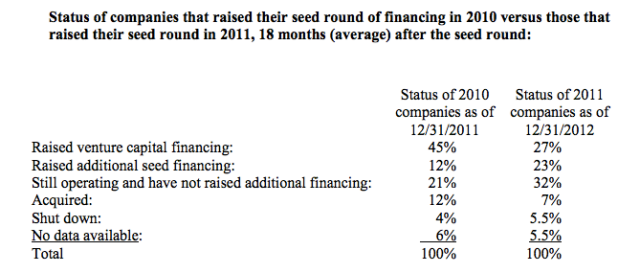

Most interesting is the third compartment, as the bet originally came from angel investors and seeds claiming there was a valuation bubble at the start. Even Sam’s post states “what seems the least reasonable are some early stage evaluations“, A very frank assessment from the then president of YC! Bubble alarms went off at least two years ago, with words like “Series A CrunchHitting the headlines (seed funding was growing exponentially; Series A deals, not so much). A SAFE with a valuation cap of $ 8 million on demo day seemed too high.

Some investors have even mentioned the invention of SAFE as proof of the bubble. YC invented and released the SAFE, with guidance from Wilson Sonsini, in late 2013, with the 2014 lots being the first to use them extensively. They replace the old style of using convertible debt notes and solve at least three very important and annoying problems. Convertibles count as debt on the balance sheet, they have interest and they have a maturity date. All 3 are undesirable for founders and, frankly, not particularly useful for investors. But somehow, SAFEs have become a hot issue with people claiming that YC intentionally flexes muscles and takes away many important protections from investors.

These feuds look bizarre in hindsight. The last thing each side wants to spend time on is the awkward process of converting a convertible note automatically. Additionally, most convertible notes gave investors the worst possible conversion price if the company had not raised by the maturity date. The original era of Series A Crunch, say 2012-2014, saw many startups and investors scramble to extend ratings, hopefully without incurring more legal fees than the actual interest on the debt.

Index fund strategy during the YC demo day?

Would investing $ 10,000 in each W15 company during the demo day evaluation provide a decent return? With 114 companies in W15, you would be ahead on paper. As expected, a small handful of stars carry the wallet. You can find them on the list of Top YC Companies (RentHop and RealtyHop are baby steps). Is it fair to say that the best W15 company is a 200x return?

For most people who complain about ratings, the most common answer is that rating doesn’t matter. All that matters is that you jump into the next kickoff of a deal. When it returns 200x or 1000x, it doesn’t matter if you’ve paid a cap of $ 10 million, $ 20 million, or $ 30 million.

What do we think of a 2021 version of the challenge? YC hosted the Winter 2021 Alumni Demonstration Day yesterday. Would a fund that could sort of invest $ 10,000 in each graduate company be ahead? We’re up to 323 graduate companies with significantly higher valuations than 2015. If three companies hit unicorn valuations, is that enough? Is 1000x achievable with an uncapped discounted SAFE or a high cap SAFE?

Mathematical Assessment Really Matters

In my limited angel investing experience (I’m not a person who doesn’t get any special treatment), if you look at the “YC Top Companies” list and your investment is somewhere in the 50-100+ rankings , the yield is 5x-15x on paper (hopefully more, eventually). For trades in the top 50, the return is on a case-by-case basis, but still lower than the last valuation divided by the cap on the day of the demonstration. Usually 1/3 to 2/3 less, due to intermediate dilution.

Where does the dilution come from? For one thing, you almost always read an article about pre-money reviews, which makes perfect sense. The pre-monetary valuation is the way to quote the valuation of the company so that the eventual size of the round does not impact the price per share. However, on each turn, all of the existing investors are crammed by about 20-25%. Some investors prorate, others don’t (angels often don’t and that makes perfect sense).

Until anyone gets a bad idea, I have no intention of causing trouble. My entire angel portfolio consists of YC companies and I have been very lucky. Also, the market clearly agrees with Demo Day ratings given the huge demand. However, the 1000x binary argument no longer holds. You might not get 1000x even if you find the best company out of the bunch. And what is your expected value? Not all lots have a 1000 bagging machine or even 100 bagging machines. And if you find one, you need to convince them to accept your money as well!

A little background from the OG team

RentHop launched the Y Combinator Summer 2009 bundle as Smarter Apartment Search (aka, Sublet your apartment without Craigslist or broker fees). The deal was $ 15,000 for 6% of the business. It was an incredible deal and we would not have made it without all the help and support from YC’s partners, network and community over the years. Our demo day valuation was a convertible note at a valuation cap of $ 1.25 million with 6% interest. Soon after, all of the starting notes eventually converted to a value of $ 10 million. To this day, our growth continues and I would like to thank everyone who has supported us all these years. We hope everyone gets their many-X feedback eventually.